Based on H1 2018 figures from STR, Marrakech has emerged as a standout performer among key African cities.

In the first half of 2018, Marrakech’s ADR (average daily rate) increased 40.7% to US$195. Despite this considerable rate growth, the market also recorded a 12.3% increase in occupancy. In terms of RevPAR (revenue per available room), a technical measure used by hotel investors and operators because it takes in to account how full a hotel is, Marrakech saw a 58.0% increase to US$124.

Thomas Emanuel expert in business development said: “Due to its proximity to markets where security concerns have hindered tourism business, Morocco’s hotel performance has suffered in recent years. As consumer confidence is returning to several of these markets, Morocco’s leisure capital, Marrakech, has seen an increase in demand and hotel operators have managed to capitalize by driving rate growth.”

Another key African destination seeing notable growth is the Cairo & Giza market. In H1 2018, occupancy went up 10.1% while ADR went up 9.6%, reaching US$93.

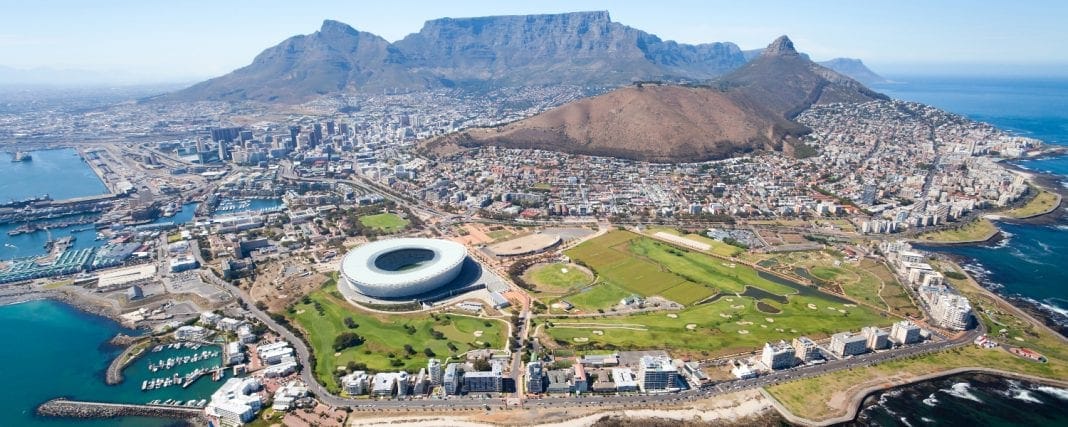

In some other major African cities, the picture for hotels is less positive. In Cape Town, for example, occupancy dropped 10.8% compared with H1 2017. With the appreciation of the South African rand against the U.S. dollar, the market recorded a 3.0% decline in ADR in local currency, but a 5.4% increase when looked at in U.S. dollars, reaching US$151.

Occupancy and rates have also fallen in Nairobi and Dar Es Salaam. In Nairobi, occupancy dropped 0.6% while ADR fell 6.5% in U.S. dollars. Dar Es Salaam saw a sharper occupancy decline (-2.1%), but a less severe rate decline (-2.7%, in USD). Both markets recorded actual occupancy levels below 50% for the first half of the year, with Nairobi operating at 49.3% and Dar Es Salaam at 47.6%.

Recent increases in demand have driven occupancy growth as well as rate growth in local currencies for both Lagos and Addis Ababa, but looking in U.S. dollars the scenario is less positive. Lagos’ occupancy was up 10.3%, but its ADR dropped 7.6% in U.S. dollars. Meanwhile, Addis Ababa saw a 7.3% increase in occupancy, but an 11.6% decline in ADR in U.S. dollars.

SOURCE: STR

هن آرٽيڪل مان ڇا وٺو:

- In terms of RevPAR (revenue per available room), a technical measure used by hotel investors and operators because it takes in to account how full a hotel is, Marrakech saw a 58.

- Recent increases in demand have driven occupancy growth as well as rate growth in local currencies for both Lagos and Addis Ababa, but looking in U.

- As consumer confidence is returning to several of these markets, Morocco's leisure capital, Marrakech, has seen an increase in demand and hotel operators have managed to capitalize by driving rate growth.